being a trader or an investor is not an easy job. there are so much information need to be gather before finally able to decide which stock is a winning one. most of the time people are using either fundamental or technical analysis. meanwhile using both usually can provide better results.

while fundamental analysis is time consuming and more analytical, technical analysis provides us which charts, indicators and oscillators. thus, most people uses technical analysis because the data presented visually and easier to understand.

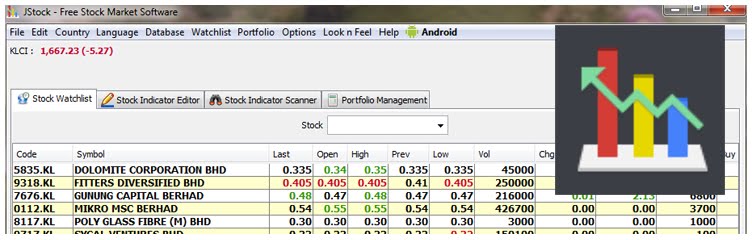

jstock is a freeware developed and provided by Yan Cheng Cheok and his team members to make daily stock screening much easier and at a minimum cost. during this posting, it is still a freeware to all.

most of the time, beginners in stock trading manually scan through hundred of listed company everyday and it is indeed a very tedious task. with the use of jstock, burden of screening potential companies can be reduce from hours to just minutes.

currently, jstock provide flexibility in screening the indicators such as Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Money Flow Index (MFI) and Exponential Moving Average (EMA). i hope that future development will include other indicators too. it is also suitable for those whom familiar with candlestick Open-High-Low-Close (OHLC).

Some of the available indicators

Open-High-Low-Close values from a candlestick also can be used to screen potential stocks